If you live and work in UAE or are doing business in UAE, you must make yourselves familiar with the Labour Laws that are present here. The UAE Labour Law provides you with your rights and protection through Ministry of Labour. Every company under the purview of Ministry of Labour is subject to UAE Labour Law. Even free zone entities refer to UAE Labour Law in their rules and regulations. Gratuity Calculation can be a daunting task if you are trying to calculate an employee’s gratuity considering the various parameters UAE Labour Law has to it. There can be many possible conditions to calculate gratuity. In this article I will provide you a most comprehensive and easy way to understand and calculate gratuity. By the end of reading this article, you’d have understood various scenarios and possibilities of calculating gratuity.

One of the most important topics under UAE Labour Law is Gratuity Calculation or End of Service Benefits/Remuneration – EOSB. While End of Service Benefits is a broader term, in this article I will use Gratuity as a term which entitles every employee with a rightful amount at the end of their employment with a company. When you resign or are terminated, you are eligible for Gratuity as per UAE Labour Law. This guide will provide you step by step guidance to calculate gratuity in case of:

Resignation;

- Unlimited Contract.

- Limited Contract.

Termination;

- Unlimited Contract

- Limited Contract.

Further there are many situations under this that are possible like term of employment. At the end of this short tutorial, you will learn how to calculate gratuity under various circumstances.

You can learn more about Unlimited Contract or Limited Contract.

Basis of Gratuity Calculation

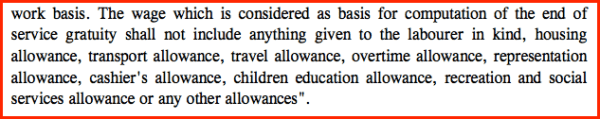

Gratuity is calculated based on the latest drawn Basic Wage. UAE labour Law also lists basic rule for Gratuity Calculation. As per the Article 132 of UAE Labour Law, it is mentioned that:

The employee who has completed one year or more in the continuous service, is entitled to the end of service remuneration at the end of his service. Days of absence from work without pay are not included in computing the period of service, and the remuneration is to be calculated as follows:

1.

Gratuity Calculation – Unlimited Contract

1.1

Resignation with Less than a year of Service

Gratuity

is applicable only when an employee completes One Year of continuous service

with a company. This is mentioned in the Section 2 – End of Service

Remuneration of the UAE Labour Law Article 132.

If an employee on unlimited contract who has resigned with a service of more than 1 year and less than 3 years, he/she is eligible for 1/3rd of 21 day’s basic salary for every year of service.

Illustration of the above:

· Basic salary = AED 10,000 per month

· Joining date = 01-01-2010

· End date = 31-03-2011

· Total number of days worked = 455 days

· Total number of years worked = 1.25 years

· 21 days’ Basic salary = AED 6904.1

· Wages per day = AED 10,000*12/365= 328.76

· Amount of wages for number of years: 21*328.76*1.25 = 8,606.49

· Gratuity Amount: 1/3*8606.49 = 2,868.83

1.3 Resignation with service of more than 3 years but less than 5 years

If an employee under unlimited contract has resigned with a total service of more than 3 years and less than 5 years, he/she will be eligible for a gratuity amount of 2/3rd of the 21 day’s basic salary for every year worked.

Illustration of the above scenario:

· Basic salary = AED 10,000 per month

· Joining date = 01-01-2008

· End date = 31-03-2011

· Total number of days worked = 1,186 days

· Total number of years worked = 3.25 years

· 21 days’ Basic salary = AED 6904.1

· Wages per day = AED 10,000*12/365= 328.76

· Amount: 21*328.76*3.25 = 22,433

· Gratuity Amount: 2/3*22,433 = 14,955.75

1.4 Resignation with service of more than 5 years

If an employee under unlimited contract has resigned with a total service of more than 5 years, for the first 5 years he/she is eligible for 21 day’s basic salary for every year worked and 30 day’s basic salary for every number years worked after that.

Illustration:

· Basic salary = AED 10,000 per month

· Joining date = 01-01-2005

· End date = 31-03-2011

· Total number of days worked (31-03-2011-01-01-2005+1)=

2281 days

· Total number of years he worked=1916/365= 6.25

· 21 days’ Basic salary = 328.76*21= AED 6,904.1

· 30 days’ basic salary=328.76*30= AED 9,863.01

· Wages per day = AED 10,000*12/365= 328.76

· Total gratuity=21*328.76*5=34,520.55+(2,218/365-5)*30*328.76=2,459.00=46,842

1.5 Termination with service of less than 1 year

If you are terminated before the completion of One year of service, you are not eligible for Gratuity. This is the basic rule of Gratuity Calculation.

1.6 Termination with service of more than 1 year and less than 3 years

If you have been terminated from your employment, with a service between 1 and 3 years, you are eligible for 21 day’s basic salary for each year worked.

Illustration:

- Joining date 1-1-2010

- End date 31-03-2012

- Basic Salary 5,000/-

per month

- Basic Salary per day

=Basic SalaryX12/365=164.38

- Total no of days

worked=Joining Date-End Date=821

- Total no of years

worked=Total no of days worked/365=2.25

- 21 days’ Basic

Salary=Basic Salary per dayX21 days=3452.05

- Gratuity Amount=Total

no of years worked*21 days’ Basic Salary=7,764.76

1.7 Termination with service of more than 3 years and less than 5 years

If you have been terminated with a total service of between 3 and 5 years, you are eligible for 21 day’s basic salary for each year of service.

Illustration:

- Joining date 1-1-2010

- End date 31-03-2014

- Basic Salary 5,000/-

per month

- Basic Salary per day

=Basic SalaryX12/365=164.38

- Total no of days

worked=Joining Date-End Date=1551

- Total no of years

worked=Total no of days worked/365=4.25

- 21 days’ Basic

Salary=Basic Salary per dayX21 days=3452.05

- Gratuity Amount=Total

no of years worked*21 days’ Basic Salary=14,668.87

1.8 Termination with service of more than 5 years

If you have been terminated or fired from your employment under unlimited contract with more than 5 years’ of service, you shall be eligible for 21 day’s basic salary for the first five years and 30 day’s basic salary for each year of service after five years.

Illustration:

- Joining date 1-1-2008

- End date 31-03-2014

- Basic Salary 5,000/-

per month

- Basic Salary per day

=Basic Salary X 12/365= 164.38

- Total no of days

worked=Joining Date-End Date= 2282

- Total no of years

worked=Total no of days worked/365=6.25

- 21 days’ Basic

Salary=Basic Salary per dayX21 days= 3452.05

- 30 days’ Basic

Salary=Basic Salary per dayX30 days= 4,931.51

- Gratuity Amount=up to

5 years=21 days salary+30 days salary after 5 years

- Total amount of

Gratuity=23,434.79

Other benefits in case of termination:

Payments equivalent to accrued but un-utilised leave or any part thereof;

Payments for overtime or any wage

due and not yet paid;

A notice period or payment due in

lieu of the notice period which is mentioned in the employment agreement;

Repatriation expenses to the

employee’s country of domicile as per the Labour Law or as stipulated in the

employment agreement;

The compensation for unreasonable

dismissal if the contract was terminated by the employer for unreasonable cause

(generally to a maximum of three months).

Please also note that company has

rights to deduct any advances, loans you have taken from the final gratuity

amount.

2. Gratuity Calculation – Limited Contract

Under limited contract, if you have terminated the contract, meaning if you as employee resign within 5 years of service, you will not be eligible for gratuity. If you have a limited contract, Gratuity is slightly different in the labor law. The factor of 1/3rd or 2/3rd does not apply under limited contract. Everything else remains the same. Below I will try and explain it in various scenarios:

2.1 Resignation without completing your Limited Contract

If you have not completed your Limited Contract as mentioned in your Contract, you will not be eligible for Gratuity under Limited Contract. Meaning, if your limited contract is for a period of 2 years, and you have resigned from your job at 1 year and 2 months, you will not be eligible for any Gratuity. This is mentioned clearly in the UAE Labour Law Article 138. The only exception to this rule is that you resign under limited contract after completing 5 years of continuous service.

If you have completed your limited

contract and it is within 1 to 5 years, you are eligible for 21 day’s basic

salary for each year of service.

Illustration:

- Joining date: 1-1-2008

- End date: 30-12-2012

- Basic Salary: 5,000/-

per month

- Basic Salary per day =

Basic SalaryX12/365=164.38

- Total no of days

worked=Joining Date-End Date=1826

- Total no of years

worked=Total no of days worked/365=5 years

- 21 days’ Basic

Salary=Basic Salary per dayX21 days=3452.05

- Gratuity Amount=Total

no of years worked*21 days’ Basic Salary=17,269.73

- 2.3 Resignation with

service of more than 5 years of service

If you have completed more than 5

years of continuous service with your company and have resigned, then for the

first 5 years you are eligible for 21 day’s basic salary and for service above

5 years, you are eligible for 30 day’s basic salary for every year of service.

Illustration:

- Joining date: 1-1-2008

- End date: 31-12-2013

- Basic Salary: 5,000/-

per month

- Basic Salary per day

=Basic SalaryX12/365=164.38

- Total no of days

worked=Joining Date-End Date=2192

- Total no of years

worked=Total no of days worked/365=6.01

- 21 days’ Basic

Salary=Basic Salary per dayX21 days=3452.05

- 30 days’ Basic

Salary=Basic Salary per dayX30 days(for above 5 years)=4931.4

- Gratuity Amount=5*21

days’ Basic Salary + 1*30 days basic salary = 22,191.00

- 2.4 Termination with

service of less than 1 year

If your length of service is less than 1 year and you have been terminated, then you are not eligible for any gratuity. However, you may be eligible for other benefits under limited contract.

2.5 Termination with service of more than 1 year

In case you are terminated from your services on Limited Contract with a service of more than 1 year up to 3 years, you are eligible for gratuity of 30 days for every year of service.

Illustration:

- Joining date 1-1-2010

- End date 31-03-2012

- Basic Salary 5,000/-

per month

- Basic Salary per day

=Basic SalaryX12/365=164.38

- Total no of days

worked=Joining Date-End Date=821

- Total no of years

worked=Total no of days worked/365=2.25

- 30 21 days’ Basic

Salary=Basic Salary per dayX30 21 days=3451.98

- Gratuity Amount=Total

no of years worked*30 21 days’ Basic Salary=7766.95

What is the maximum Gratuity that

you can get?

Under Article 132 of Labor Law, you can clearly read that the maximum gratuity amount can not exceed 2 years’ gross salary.

Do I get 3 month salary in case of

termination?

Under Limited Contract, if you are terminated for any reason

other than mentioned in Article 120, you are eligible for 3 month’s

compensation or remuneration till the end of your remaining contract, whichever

is shorter. This is covered in the Article 115 of the UAE Labour Law.

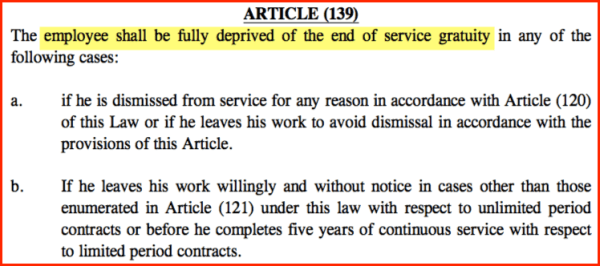

When is gratuity not applicable?

When is gratuity not applicable?

1.

If you are terminated or dismissed

as per the provisions of Article 120 of UAE labour Law;

2.

If you leave work without serving

notice period other than for factors under Article 121 under unlimited

contract;

3.

If you leave or resign from limited

contract before completion of 5 years.

Article

121 of UAE Labour Law

What

should you do if your employer does not settle your lawful gratuity?

If you do not receive your gratuity

or end of service remuneration, you could visit MOL or log on to their online

portal to file a complaint of non-receipt of your gratuity.

As emphasised earlier, it makes all

the sense for you to calculate and be satisfied with your gratuity calculation

in case you are terminated or if you have resigned from your job. Many

employers do take advantage of their employees by falsifying the gratuity

report.

No comments:

Post a Comment